Skyrocketing Ocean Freight Rates: A New Crisis for Importers and Exporters

Major port congestion alert! Ships are piling up in Asia and Europe, causing delays and potential disruptions to global supply chains. Stay tuned for updates as we monitor this developing situation. #portcongestion #supplychain

Vietnam Pepper Market Update: June 2024 – A Spicy Surge

The Vietnam pepper market is on fire, with prices reaching a scorching 144,000 VND per kilogram. This marks a dramatic 112% increase year-over-year and the highest price in nine years. The rapid ascent has surprised consumers and businesses alike, with pepper now surpassing coffee and cocoa in value. Some even quip that “pepper is rising faster than gold.”

The Heat is On: Supply and Demand Dynamics

High prices haven’t deterred demand. In fact, farmers are holding onto their stock, anticipating further price increases. This is putting pressure on exporters struggling to fulfill contracts. Even established spice exporters to the US and EU are feeling the pinch, rationing their dwindling inventories and cautiously purchasing new supplies.

The current shortage is attributed to low stockpiles in major producing countries like Vietnam, India, and Brazil, coupled with robust global demand. Vietnam’s pepper production is projected to drop further in 2024 due to El Nino, exacerbating the supply crunch.

Global Market: A Fiery Outlook

Vietnam dominates the global pepper market, accounting for 40% of production and 60% of the market share. The global pepper market is valued at approximately $5.4 billion USD and is forecasted to grow at an average of 20% annually from 2024 to 2032.

The US remains Vietnam’s largest pepper export market, followed by China, India, and Germany. The International Pepper Community (IPC) reports rising prices for black pepper in Indonesia and stable prices in Brazil and Malaysia, further fueling the global price surge.

Export Performance: A Five-Month Sizzle

In the first five months of 2024, Vietnam exported 114,424 tons of pepper, including 100,971 tons of black pepper and 13,453 tons of white pepper. The total export value reached 493.1 million USD, with black pepper accounting for 417.7 million USD and white pepper for 75.4 million USD.

The United States remained Vietnam’s largest pepper export market, receiving 30,466 tons. Germany emerged as the second-largest export market, importing 7,532 tons. Other significant markets included India (6,933 tons), the UAE (5,639 tons), the Netherlands (5,067 tons), and China (4,871 tons). Several markets experienced impressive export growth, such as Italy (179.0%), Russia (49.7%), Spain (49.1%), and Egypt (39.0%). Germany, the US, the Netherlands, Thailand, and China were the largest consumers of Vietnamese white pepper.

Prosi: A Rising Star in the Pepper Export Arena

Amidst the market frenzy, Prosi has emerged as a standout performer. As a top 10 Vietnamese exporter, Prosi recorded a remarkable 18.4% increase in exports during the first five months of 2024, reaching 3,021 tons. This achievement underscores Prosi’s growing reputation for quality, reliability, and adaptability in the dynamic pepper market.

The Road Ahead: A Spicy Forecast

Experts predict that the pepper market has entered a new price cycle, expected to last 8-10 years. The current price surge has already exceeded the most optimistic forecasts, and the market shows no signs of cooling down.

#ProsiThangLong#Prosi#GlobalTrade#VietnamSpices#VietnamNuts#Pepper#Cashew#Cinnamon#Coconut#StarAnise#VietnamExporter

——————————-

𝐏𝐫𝐨𝐬𝐢 𝐓𝐡𝐚𝐧𝐠 𝐋𝐨𝐧𝐠 – 𝐒𝐩𝐢𝐜𝐞𝐬 𝐚𝐧𝐝 𝐍𝐮𝐭𝐬 𝐕𝐢𝐞𝐭𝐧𝐚𝐦 𝐌𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫 𝐚𝐧𝐝 𝐄𝐱𝐩𝐨𝐫𝐭𝐞𝐫

![]() 𝐀𝐝𝐝𝐫𝐞𝐬𝐬: 4th Floor, Kim Anh Building, No 78 Duy Tan, Cau Giay, Ha Noi

𝐀𝐝𝐝𝐫𝐞𝐬𝐬: 4th Floor, Kim Anh Building, No 78 Duy Tan, Cau Giay, Ha Noi

![]() 𝐄𝐦𝐚𝐢𝐥: Sales@prosi.com.vn

𝐄𝐦𝐚𝐢𝐥: Sales@prosi.com.vn

![]() 𝐎𝐟𝐟𝐢𝐜𝐞 𝐇𝐨𝐭𝐥𝐢𝐧𝐞: (+84) 9858 17797

𝐎𝐟𝐟𝐢𝐜𝐞 𝐇𝐨𝐭𝐥𝐢𝐧𝐞: (+84) 9858 17797

𝐘𝐨𝐮𝐫 𝐭𝐫𝐮𝐬𝐭𝐞𝐝 𝐩𝐚𝐫𝐭𝐧𝐞𝐫 𝐢𝐧 𝐩𝐫𝐞𝐦𝐢𝐮𝐦 𝐬𝐩𝐢𝐜𝐞𝐬 𝐚𝐧𝐝 𝐧𝐮𝐭𝐬

39 Vietnamese Companies Flagged for Suspected Export Fraud – VPSA Warns Exporters to Exercise Caution

The Vietnam Pepper and Spice Association (VPSA) has released a list of 39 companies suspected of fraudulent activities in exporting goods. Exporters are urged to exercise extreme caution when dealing with these entities.

According to www.complaintsboard.com, several companies have been identified as potentially engaging in fraudulent practices. For new customers or first-time transactions, it’s recommended to seek assistance from the Vietnamese Trade Office in the respective country to verify the importer’s information.

The pepper and spice industry, in particular, along with the broader agricultural export sector, has been repeatedly targeted by international scams. Recently, the Asia-Africa Market Department (Ministry of Industry and Trade) helped a Vietnamese company resolve a case involving a suspected fraudulent import from the UAE, saving the company from a potential loss of 526,257 USD (approximately 13.4 billion VND).

In 2023, 5 containers of pepper, cinnamon, cashew nuts, and star anise worth nearly half a million USD were scammed in the Dubai market. Thanks to the intervention of relevant authorities, the shipments were recovered, but the costs incurred in pursuing legal action were significant.

VPSA strongly advises businesses to be cautious when dealing with these companies. For first-time transactions or new customers, it’s recommended to seek assistance from the Vietnamese Trade Office in the respective country to verify the importer’s information.

To minimize risks in trade transactions with partners in West Asia, the Ministry of Industry and Trade also recommends that businesses be extremely cautious with large-value contracts and partners found online.

.

📜 List of suspected companies

- Yejd Al Taam Food Trading Co., Ltd.

- Ardh Al Nakheel Sharjah Trading Co., Ltd.

- Regal Plus General Trading Co., Ltd.

- Royal Deluxe Food Trading Co., Ltd.

- Oral Star Food Trading Co., Ltd.

- Freshbazaar (No company)

- Dar Al Nukhba Food Trading Co., Ltd.

- Minsa Creative Co., Ltd.

- Galaxy Delight Import Export General Trading Co., Ltd.

- Nam Song Food Trading Co., Ltd.

- Abid Food Supply Services Co., Ltd.

- Arshmaan Food Trading Co., Ltd.

- Organicaa Food Trading Co., Ltd.

- Oral Star Food Trading Co., Ltd.

- EZY Goods Wholesale Co., Ltd.

- Green Nature Food Trading Co., Ltd.

- Green Cell Food Trading Co., Ltd.

- Salat Al Ahlam General Trading Co., Ltd.

- Sohaz Food Trading Co., Ltd.

- Bab Al Shams Food Trading Co., Ltd.

- Green Grape Food Trading Co., Ltd.

- Shahnoor Food Trading Co., Ltd.

- Sky Link Food Trading Co., Ltd.

- Syahm Goods Wholesale Co., Ltd.

- Bright Century Goods Wholesale Co., Ltd.

- Shorooq Al Deira Food Trading Co., Ltd.

- Green House Food Trading Co., Ltd.

- New Marhaba Food Trading Co., Ltd.

- Agro Link Food Trading FZE

- Blue Bay Food Trading Co., Ltd.

- Zafar Iqbal Fruit and Vegetable Trading Co., Ltd.

- Wadi Al Zain Food Trading Co., Ltd.

- Evergreen Food Trading Co., Ltd.

- Muhammad Asim Food and Fish Trading Co., Ltd.

- Green Tower Food Trading Co., Ltd.

- Makhmali Food Trading Co., Ltd.

- Najmat Al Maizan Food Trading Co., Ltd.

- ACP Food Trading Co., Ltd.

- Wahat Al Rawahil General Trading Co., Ltd.

Prosi – Your Trusted Partner in Spice Exports

As a leading and reputable spice exporter in Vietnam, Prosi is committed to upholding the highest standards of integrity and transparency in all our dealings. We prioritize building long-term relationships with our partners based on trust and mutual success. Contact us today to learn more about our premium cinnamon and star anise products.

#ProsiThangLong#Prosi#GlobalTrade#VietnamSpices#VietnamNuts#Pepper#Cashew#Cinnamon#Coconut#StarAnise#VietnamExporter

——————————-

𝐏𝐫𝐨𝐬𝐢 𝐓𝐡𝐚𝐧𝐠 𝐋𝐨𝐧𝐠 – 𝐒𝐩𝐢𝐜𝐞𝐬 𝐚𝐧𝐝 𝐍𝐮𝐭𝐬 𝐕𝐢𝐞𝐭𝐧𝐚𝐦 𝐌𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫 𝐚𝐧𝐝 𝐄𝐱𝐩𝐨𝐫𝐭𝐞𝐫

![]() 𝐀𝐝𝐝𝐫𝐞𝐬𝐬: 4th Floor, Kim Anh Building, No 78 Duy Tan, Cau Giay, Ha Noi

𝐀𝐝𝐝𝐫𝐞𝐬𝐬: 4th Floor, Kim Anh Building, No 78 Duy Tan, Cau Giay, Ha Noi

![]() 𝐄𝐦𝐚𝐢𝐥: Sales@prosi.com.vn

𝐄𝐦𝐚𝐢𝐥: Sales@prosi.com.vn

![]() 𝐎𝐟𝐟𝐢𝐜𝐞 𝐇𝐨𝐭𝐥𝐢𝐧𝐞: (+84) 9858 17797

𝐎𝐟𝐟𝐢𝐜𝐞 𝐇𝐨𝐭𝐥𝐢𝐧𝐞: (+84) 9858 17797

𝐘𝐨𝐮𝐫 𝐭𝐫𝐮𝐬𝐭𝐞𝐝 𝐩𝐚𝐫𝐭𝐧𝐞𝐫 𝐢𝐧 𝐩𝐫𝐞𝐦𝐢𝐮𝐦 𝐬𝐩𝐢𝐜𝐞𝐬 𝐚𝐧𝐝 𝐧𝐮𝐭𝐬

Unlock the Star Power of Anise: Your Health and Flavor Boost

Star anise, a star-shaped spice with a captivating licorice-like flavor, isn’t just a culinary gem. From enhancing savory dishes to sweetening desserts, this versatile spice has been a staple in kitchens worldwide. But did you know it also packs a powerful punch for your health?

Prosi: Vietnam’s Leading Star Anise Exporter

As Vietnam’s number one star anise exporter, Prosi is proud to bring you the highest quality star anise sourced directly from the lush landscapes of Vietnam. Our commitment to excellence ensures you receive only the finest, most flavorful star anise for your culinary and wellness needs.

The Star-Studded Health Benefits of Star Anise

- Heart Health Hero: Research suggests that star anise may support cardiovascular well-being by potentially reducing the risk of atherosclerosis, a major contributor to heart attacks.

- Mood Booster: Rich in vitamin B, star anise can help alleviate feelings of anxiety and depression, promoting a more balanced and positive mood.

- Digestive Aid: Star anise’s soothing properties can ease digestive discomfort, helping you feel your best from the inside out.

- Cold and Flu Fighter: A warm cup of star anise tea can offer relief from coughs, sore throats, and other cold and flu symptoms, thanks to its natural antibacterial properties.

- Blood Sugar Balancer: Emerging research suggests that star anise may play a role in managing blood sugar levels, making it a potential ally for individuals with diabetes.

- Beyond the Kitchen: Star anise’s benefits extend beyond the culinary realm. It may also contribute to skin health and overall wellness.

FAQs: Your Star Anise Questions Answered

- Who should avoid star anise? While generally safe for most adults in moderation, children should avoid star anise due to potential side effects.

- How long does star anise last? When stored properly in an airtight container, whole star anise can retain its freshness for up to three years.

- What does star anise taste like? Star anise boasts a slightly sweet flavor with subtle hints of licorice.

Unlock the Full Potential of Star Anise with Prosi

Elevate your culinary creations and embrace the wellness potential of star anise with Prosi’s premium quality star anise. Let Prosi be your trusted partner in unlocking the star power of anise for a healthier, more flavorful life.

Contact us today to explore partnership opportunities and discover how Prosi can meet your star anise needs.

Entering the European market for cashew nuts

I. Introduction

The European market represents a significant opportunity for cashew nut exporters. Europe’s demand for cashew nuts is driven by their use in various food products and increasing consumer preference for healthy snack options. As this market continues to grow, understanding the regulatory and competitive landscape is crucial for successful market entry.

1. Overview of the Cashew Nut Market Relevance in Europe

Cashew nuts are popular in Europe due to their nutritional value and versatility in food applications, from snacks to culinary dishes. Europe imports a substantial volume of cashew nuts to meet consumer demand, making it a lucrative market for producers.

2. Importance of Understanding Market Entry Requirements

Entering the European market requires adherence to strict food safety and quality standards. Exporters must navigate complex regulatory frameworks, including certifications and standards for product safety, to gain market access and consumer trust. Understanding these requirements is essential for establishing a successful export business in this competitive environment.

II. Market Entry Requirements for Cashew Nuts in the European Market

1. Compliance with European Food Safety Standards

To enter the European market, cashew nuts must adhere to strict food safety standards to ensure they are safe for consumption. These standards include:

- Contaminant Controls: Cashew nuts must meet the stringent limits set for contaminants. The European Union’s Regulation (EU) 2023/915 specifies maximum levels for contaminants like mycotoxins, pesticide residues, microorganisms, and heavy metals. For example, the level of aflatoxin B1 in cashew nuts must not exceed 5 µg/kg, and the total aflatoxin content must not surpass 10 µg/kg.

- Additives and Allergens: Only approved additives are allowed in products containing cashew nuts, as specified in Regulation (EU) No 231/2012. Due to the high allergenic potential of cashew nuts, clear labeling indicating the presence of cashew nuts is mandatory to protect consumers from severe allergic reactions.

2. Mandatory Certifications and Tests

- GFSI Recognized Certifications: Cashew nut exporters to the EU should obtain certifications recognized by the Global Food Safety Initiative (GFSI), such as BRC, IFS, or SQF. These certifications ensure that food safety practices meet international standards.

- Pesticide Residue Testing: The EU sets Maximum Residue Levels (MRLs) for pesticides, and cashew nuts must be tested to ensure compliance. Regular updates to the list of approved pesticides and new regulations, like Commission Regulation (EU) 2020/749, emphasize the control of specific chemicals like chlorates.

3. Phytosanitary Certificates and Contaminant Controls

- Phytosanitary Certificates: For certain types of cashew nuts, particularly whole, fresh ones in the green husk, a phytosanitary certificate is required when importing into the EU from third countries. This certificate verifies that the nuts have been inspected and are free from harmful pests and diseases.

- Microbiological and Heavy Metal Controls: Cashew nuts are also scrutinized for microbiological contaminants like salmonella and E. coli, which are critical public health risks. Regulation (EU) 2023/915 also sets the maximum level of cadmium for cashew nuts at 0.20 mg/kg of wet weight, except for nuts used for crushing and oil refining.

By meeting these requirements, cashew nut exporters can ensure their products are eligible for the European market, safeguarding public health and complying with regulatory standards. This not only protects consumers but also enhances the marketability of their products within Europe.

III. Additional Market Requirements for Cashew Nuts

1. Quality Requirements

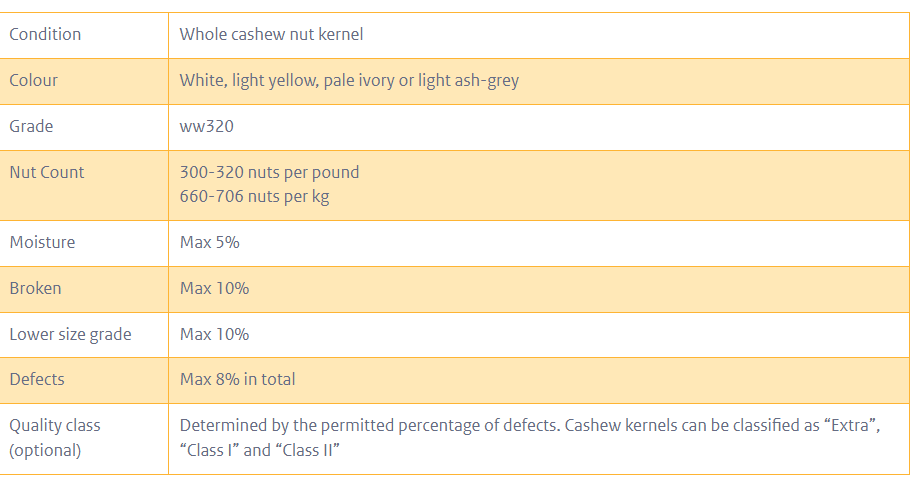

Cashew nut kernels must meet specific quality standards to satisfy European buyers. The United Nations Economic Commission for Europe (UNECE) provides a widely accepted standard in Europe, despite the lack of specific EU standards. Key quality attributes include:

- Size and Grade: Cashew kernels are categorized based on size, with labels such as W450, W320, indicating fewer kernels per pound and thus larger size, which is typically associated with higher quality.

- Defects: Quality is also assessed by the presence of defects, such as broken pieces or damage by insects. For instance, whole nuts are preferred over broken ones, and nuts without any discoloration (black or brown spots) are considered of superior quality.

- Moisture Content: A maximum moisture content of 5% is a general requirement to prevent mold and ensure freshness.

2. Food Safety Certification

Food safety certification is crucial for cashew nut importers in Europe, even though not explicitly mandated by legislation. Most importers require one of the certifications recognized by the Global Food Safety Initiative (GFSI), including:

- International Featured Standards (IFS)

- British Retail Consortium Global Standards (BRCGS)

- Food Safety System Certification (FSSC 22000)

- Safe Quality Food Certification (SQF)

Exporters need to ensure their certifications are up-to-date and recognized under the latest GFSI benchmarking requirements. Different certifications might be preferred by buyers in various countries, influenced by historical or operational preferences.

3. Packaging Requirements

Packaging plays a significant role in preserving the quality of cashew nuts during transit and storage:

- Common Packaging Types: Exported cashews are often packed in 10 kg to 25 kg polybags or flexi packs, with some opting for airtight tins for enhanced preservation.

- Vacuum Sealing: To extend shelf life, bags are vacuum-sealed, with air replaced by inert gases like carbon dioxide and nitrogen.

- Container Optimization: Packaging is designed to optimize container and pallet space, crucial for reducing shipping costs and ensuring the nuts’ protection during transport.

4. Labelling Requirements

Labelling is rigorously regulated to ensure consumer safety and compliance with trade standards:

- Bulk Packaging: Labels on bulk packages typically include the product name, quality, grade, and crop year. Essential storage instructions must be visible to maintain the product’s high oil content.

- Origin Labelling: European regulations require clear labelling of the product’s origin, which is particularly important for traceability and consumer information.

- Retail Packaging: For retail sales, the EU’s regulation on the provision of food information to consumers mandates clear allergen labelling (cashews are recognized as a common allergen), nutrition labelling, and legibility requirements.

By understanding and adhering to these additional buyer requirements, cashew nut exporters can significantly enhance their marketability and maintain compliance with European standards, ultimately fostering successful business relationships with European importers.

IV. Requirements for Niche Markets in the Cashew Nut Industry

1. Organic Cashew Nuts

To market cashew nuts as organic within Europe, adherence to the stringent requirements set forth by European organic legislation is essential:

- Certification Process: Organic cashew nuts must be grown and processed using certified organic methods. Before marketing products as organic in Europe, the production facilities must be audited and certified by an accredited certifier. Only after passing these audits can the European Union’s organic logo, and possibly other relevant organic standards’ logos (like Soil Association or Naturland), be displayed on products.

- Regulatory Compliance: The EU’s organic legislation, updated in January 2022, enhances the control systems and extends the range of products that can be marketed as organic. This new regulation aims to strengthen consumer trust by ensuring that both locally produced and imported organic products meet the same stringent standards.

- Electronic Certificate of Inspection: Every batch of imported organic cashew nuts must be accompanied by an electronic certificate of inspection (e-COI) to ensure compliance with EU standards.

2. Sustainability and Corporate Social Responsibility (CSR) Certification

Sustainability certifications are increasingly critical for cashew nut exporters aiming to appeal to ethically conscious consumers:

- Certification Schemes: The Fairtrade and Rainforest Alliance are among the most prevalent sustainability certifications in the cashew nut industry. Fairtrade specifically caters to small-scale producer organizations and includes stipulations on worker protection, terms of payment, and a Fairtrade Minimum Price.

- Sustainable Nuts Initiative: Launched by a consortium of European companies in 2015, this initiative focuses on improving conditions in nut-producing countries and promoting sustainable sourcing practices. Participation in such initiatives can be a significant selling point for European buyers.

- Ethical Standards: Many companies also require adherence to their specific codes of conduct or widely recognized standards such as the Sedex Members Ethical Trade Audit (SMETA), which evaluates labor rights, health & safety, environmental practices, and business ethics.

3. Ethnic Certification

Targeting ethnic niche markets can open additional avenues for cashew nut sales, especially within communities observing religious dietary laws:

- Halal Certification: With the growing Muslim population in Europe, projected to reach over 7% by 2050, Halal certification can significantly enhance market access. Certification ensures that the cashew nuts comply with Islamic dietary laws, increasing their appeal in Muslim-dominated countries. Bodies like Halal Certification Services (HCS) provide these certifications, which are essential for entering these markets.

- Kosher Certification: Similar to Halal, Kosher certification caters to Jewish consumers by ensuring that cashew nuts meet Jewish dietary laws. Organizations such as the Kosher London Beth Din (KLBD) offer guidelines and certification services, making products suitable for Jewish markets.

By meeting the requirements for these niche markets, cashew nut exporters can significantly broaden their consumer base, appealing to segments that value organic production, sustainability, and adherence to religious dietary standards. This not only aligns with global trends towards more ethical consumption but also opens up lucrative market segments that are increasingly influential in the global trade landscape

V. Segmentation of the European End-Market for Cashew Nuts

1. Snack Segment

The snack segment is the primary market for cashew nuts in Europe, accounting for approximately 90% of imported cashew nut kernels. This segment primarily enjoys cashew nuts as:

- Roasted and Salted Snacks: Roasted salty snacks dominate the cashew snacking scene in Europe. These snacks cater to a broad audience seeking convenient and tasty options.

- Health-Focused Alternatives: Following the health and wellness trend, there is a growing demand for unsalted, slow-roasted, dry-roasted, and even unroasted cashew nuts. These options are perceived as healthier alternatives to traditional salted snacks.

- Flavor Innovations: The industry is continually developing new roasting flavors and coatings (both salty and sweet) to diversify offerings and cater to evolving consumer taste preferences. The variety includes natural, spiced, and mixed nut options, expanding the appeal to a wider audience.

- Market Influences: The snacking segment’s dynamics are influenced by several factors, including economic conditions such as inflation, as well as lifestyle trends like hybrid working models leading to more at-home snacking occasions. Despite challenges like supply chain disruptions and high inflation, the resilience in consumer spending is bolstered by the growing importance of health in daily nutrition.

2. Ingredient Segment

Though smaller compared to the snack segment, the ingredient segment holds significant potential and accounts for about 10% of the European cashew market. Cashew nuts are increasingly utilized by the food processing industry in various applications:

- Confectionery: In the confectionery industry, cashew nuts are used whole or in pieces to create chocolate-coated snacks and other sweets. This follows the successful model of chocolate-coated almonds, with innovations like caramel-coated cashew kernels gaining popularity.

- Bakery: Cashew nuts are used both split and whole in bakeries, often as toppings or fillings in cookies, pastries, and other baked goods.

- Nut Spreads and Butters: There is a growing trend toward cashew nut spreads and butters, marketed as healthier alternatives to traditional peanut butter. These products often come in various flavors, enhancing their appeal.

- Breakfast Cereals: The breakfast cereals sector is incorporating cashew nuts into nut-rich granola products, responding to consumer demand for nutritious and satisfying options.

- Protein and Fruit-Nut Bars: As a healthier snacking alternative, protein and fruit-nut bars that incorporate cashew nuts are becoming more prevalent. These bars offer a good source of plant protein and align with the trend toward healthier snack options.

- Ready Meals and Sauces: Cashew nuts find a place in ready meals and sauces, such as pesto, where they serve as a cost-effective alternative to more expensive nuts like pine nuts.

The European market for cashew nuts is robust, with clear segmentation between snacks and ingredients. Each segment has distinct consumer bases and uses that drive the demand for different qualities and types of cashew nuts. Understanding these market segments helps producers and suppliers better tailor their products and marketing strategies to meet specific consumer needs and preferences, potentially leading to increased market share and revenue

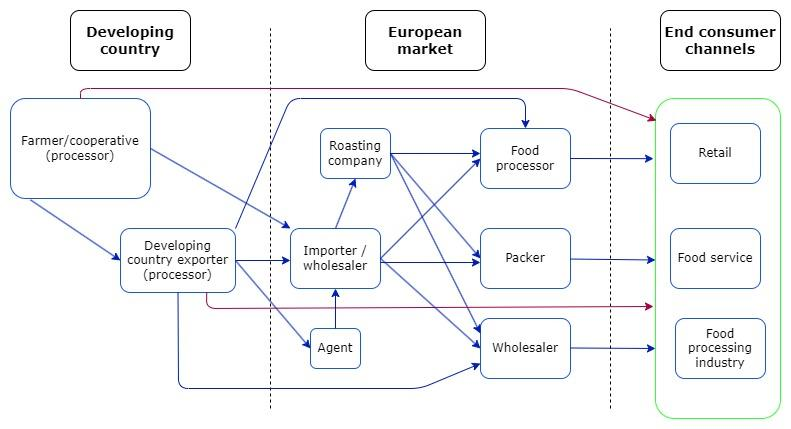

VI. Overview of the Distribution Channels for Cashew Nuts in the European Market

The European market for cashew nuts offers various channels through which cashew nuts are distributed, each catering to different segments of the market and having specific requirements. Understanding these channels is crucial for suppliers aiming to enter or expand within the European market. Here’s a breakdown of the primary channels:

1. Importers/Wholesalers

Importers and wholesalers play a pivotal role as the main conduit for cashew nuts entering the European market. They often have:

- Processing and Packing Facilities: Many importers own facilities where they can process and pack cashew nuts, directly supplying the retail and food service channels.

- Market Influence: These entities face significant pressure from the retail sector, which demands not only competitive pricing but also value-added products like organic or fair-trade certified nuts.

- Key Players: Companies like August Töpfer & Co. (ATCO) and Olam International are significant players, with direct sourcing and processing capabilities in cashew-producing countries.

2. Agents/Brokers

Agents and brokers act as intermediaries in the cashew nut trade, facilitating transactions between European buyers and global sellers. They:

- Charge Commissions: Typically, they charge a commission for their services, which ranges from 2% to 4%.

- Provide Private Label Services: They also help in sourcing and packaging for private labels required by European retail chains, a complex process often out of reach for smaller or less equipped exporters.

3. Retail Channel

The retail channel, while a major consumer of packaged cashew nuts, often does not engage directly with exporters from developing countries due to stringent quality and logistic requirements. Key aspects include:

- Market Dynamics: The market is increasingly polarized, with shifts towards either discount or premium segments.

- Major Retailers: Prominent players include Schwartz Gruppe, Carrefour, and Tesco, among others, with several forming buying alliances to coordinate purchasing operations across Europe.

4. Food service Channel

This channel caters to establishments like hotels, restaurants, and caterers, requiring specific product formats:

- Packaging Requirements: Cashew nuts in the food service sector are often needed in smaller packages ranging from 1kg to 5kg, contrasting with the bulk requirements of other channels.

- Growth Areas: There is growing demand in segments such as healthy fast food, international cuisines, and street food establishments.

VII. Most Interesting Channel: Importers/Wholesalers

For new exporters targeting the European market, the channel of importers and wholesalers is particularly intriguing due to several reasons:

- Market Knowledge: These importers have a deep understanding of market trends and maintain close monitoring of developments in cashew-producing countries.

- Relationship Potential: Building a lasting relationship with established importers can provide new exporters with crucial market entry support and ongoing advice.

- Diverse Product Handling: Importers who handle various types of nuts and dried fruits can offer more opportunities for suppliers that can diversify their product offerings.

Overall, while the retail channel may seem attractive due to its size, the complexities and investments required make it a challenging option for new entrants. Working with specialized importers and wholesalers provides a more accessible and supportive pathway into the European market, making it the most interesting and strategic channel for new suppliers aiming to establish a foothold and grow their presence in Europe.

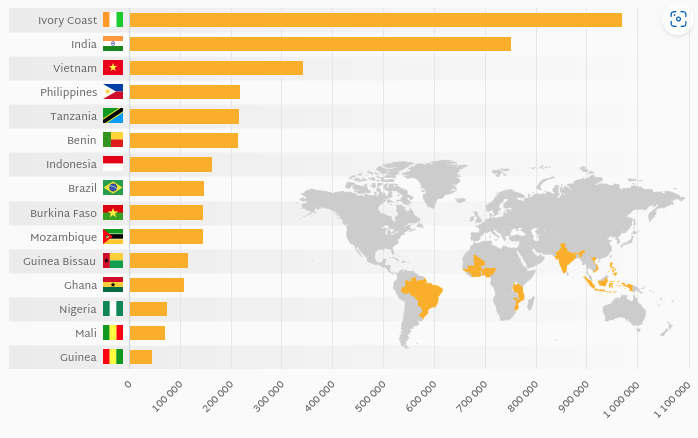

VIII. Vietnam’s Dominance in the European Cashew Nut Market

Vietnam stands as the preeminent leader in exporting cashew nut kernels, not only to Europe but globally. In 2022, Vietnam claimed the title of the top exporter, responsible for approximately two-thirds of the world’s cashew exports, with major markets including the USA, the European Union, the UK, and China. Despite its lower production compared to other countries like Côte d’Ivoire, India, and Cambodia, Vietnam’s substantial export volumes are supported by its extensive shelling capacity.

In the 2022-2023 period, Vietnam’s cashew crop was substantial, with a reported yield of 103,500 tonnes, as per the latest statistics from the International Nut and Dried Fruit Council (INC). The country compensates for its lower production by importing raw in-shell cashew nuts, primarily from Cambodia, Côte d’Ivoire, and other nations such as Ghana, Nigeria, Tanzania, Senegal, and Indonesia. Notably, Vietnamese imports from Côte d’Ivoire have decreased due to the expansion of processing capacities there, while imports from Cambodia are on the rise, reflecting increased investments by Vietnamese processors in the Cambodian cashew industry.

The logistics of importing cashew nuts from West Africa are facilitated by major shipping firms, with CMA CGM providing dedicated fortnightly shuttle services from West Africa to major markets like India and Vietnam, ensuring a steady supply throughout the cashew season.

Despite its strong export focus, where around 95% of its cashew kernels are sent abroad, Vietnam’s domestic consumption remains minimal. In 2021, Vietnam exported approximately 456,000 tonnes of cashew kernels. The United States was the largest market, followed by Europe, which received about 30% of the exports. The Vietnamese cashew exports to Europe showed a robust annual growth of 9.2%, totaling 134,000 tonnes in 2022. The forecast for exports to Europe remains optimistic, with expectations of continued high single-digit growth rates.

Binh Phuoc province, known as the “cashew nut capital” of Vietnam, is a significant area for cashew production. The province boasts 141,595 hectares dedicated to cashew crops and produces over 200,000 tonnes of raw cashews annually. Nearly 300 companies in Binh Phuoc are engaged in cashew processing, with several also involved in the export business.

In recent years, Vietnam has seen a shift from manual to mechanized cracking of cashews due to labor shortages, enhancing efficiency in processing. The Vietnamese Ministry of Agriculture and Rural Development (MARD) not only fosters domestic production but also collaborates with Cambodia to secure reliable sources for its processing industry. The Vietnam Cashew Association (VINACAS) promotes technological advancement and marketing efforts, while the Vietnam Trade Promotion Agency bolsters the country’s cashew export activities.

Vietnam’s strategic investments in processing capabilities and international collaborations underscore its pivotal role in the global cashew market, particularly in catering to European demand.

IX. Conclusion

The European market presents a dynamic and promising landscape for cashew nut exporters, underpinned by a growing consumer preference for healthy snacks and the versatility of cashew nuts in various culinary applications. As exporters navigate this lucrative market, understanding and adhering to the stringent regulatory requirements is paramount. This not only ensures compliance but also builds trust among European consumers, enhancing the marketability of their products.

Strict food safety standards, necessary certifications, and detailed packaging and labeling requirements define the entry and successful participation in the European market. Exporters must meet these standards to not just enter the market but to thrive within it, ensuring their products are both safe and appealing to the European palate.

Moreover, the market’s segmentation into snack and ingredient sectors, along with niche markets like organic, sustainable, and ethically certified products, offers exporters multiple avenues to diversify their offerings and tap into various consumer segments. This segmentation highlights the need for tailored strategies that align with the specific preferences and requirements of each segment, thereby maximizing the potential for growth and profitability.

Furthermore, the role of Vietnam as a dominant player in the global cashew market, particularly in Europe, exemplifies the importance of strategic market positioning and investment in processing capabilities. Vietnam’s model of leveraging extensive shelling capacity and robust export strategies provides valuable insights for other producers aiming to enhance their presence in international markets.

In conclusion, the European cashew nut market, with its diverse consumer base and strict standards, offers significant opportunities for exporters. By strategically navigating the regulatory landscape, embracing market segmentation, and investing in quality and sustainability, exporters can effectively expand their footprint in Europe and capitalize on the growing demand for this versatile nut.

#ProsiThangLong #Prosi #GlobalTrade #VietnamSpices #VietnamNuts #Pepper #Cashew #Cinnamon #Coconut #StarAnise #VietnamExporter

——————————-

𝐏𝐫𝐨𝐬𝐢 𝐓𝐡𝐚𝐧𝐠 𝐋𝐨𝐧𝐠 – 𝐒𝐩𝐢𝐜𝐞𝐬 𝐚𝐧𝐝 𝐍𝐮𝐭𝐬 𝐕𝐢𝐞𝐭𝐧𝐚𝐦 𝐌𝐚𝐧𝐮𝐟𝐚𝐜𝐭𝐮𝐫𝐞𝐫 𝐚𝐧𝐝 𝐄𝐱𝐩𝐨𝐫𝐭𝐞𝐫

🏢 𝐀𝐝𝐝𝐫𝐞𝐬𝐬: 4th Floor, Kim Anh Building, No 78 Duy Tan, Cau Giay, Ha Noi

📨 𝐄𝐦𝐚𝐢𝐥: Sales@prosi.com.vn

📞 𝐎𝐟𝐟𝐢𝐜𝐞 𝐇𝐨𝐭𝐥𝐢𝐧𝐞: (+84) 9858 17797

𝐘𝐨𝐮𝐫 𝐭𝐫𝐮𝐬𝐭𝐞𝐝 𝐩𝐚𝐫𝐭𝐧𝐞𝐫 𝐢𝐧 𝐩𝐫𝐞𝐦𝐢𝐮𝐦 𝐬𝐩𝐢𝐜𝐞𝐬 𝐚𝐧𝐝 𝐧𝐮𝐭𝐬

Overview of Vietnamese Star Anise

This article offers an in-depth look at Vietnamese star anise, highlighting its importance in cuisine, health, and as a key export product. It covers the spice’s characteristics, growth, and processing, revealing how these factors contribute to its quality. The piece also explores star anise’s chemical makeup, showcasing its diverse health benefits and culinary uses. Additionally, it provides practical advice on selecting and storing star anise to preserve its flavors. Finally, the article introduces Prosi Thăng Long, a major exporter, emphasizing the spice’s role in Vietnam’s agricultural success and its global market presence.

Vietnamese Pepper Market Analysis: Challenges and Opportunities

This report provides an in-depth analysis of the challenges and opportunities facing the Vietnamese pepper market, including production declines, regulatory pressures, and international competition. It highlights the importance of sustainable development, quality improvement, and strategic market diversification to navigate the complex global landscape. The report underscores the need for the Vietnamese pepper industry to adapt to new regulations, enhance traceability, and engage in cooperative models to maintain its competitiveness in the global spice market.

Vietnam’s Star Anise Export Analysis Report: A Valuable Economic Opportunity

Star Anise is a product of the star anise tree, a type of plant that thrives and grows in limited regions worldwide, including some provinces in Vietnam and China. The star anise tree ranges from 2 to 6 meters in height, with straight trunks and thick, fragrant leaves. Notably, the star anise tree only begins to yield flowers from the fourth year onwards after planting, with stable yields achieved after 20 years.

Star Anise is not only widely used in Vietnamese cuisine as a seasoning for dishes like pho and curry but also known for its ability to stimulate the taste buds and create appetizing sensations. This enhances the value of star anise, not just as an agricultural product but also as a crucial component in the food industry.

Market Summary:

In the global market context, star anise, a particularly rare and valuable product, has brought Vietnam significant revenue, with nearly 8 million USD in just the first two months of 2024. Known as a hard-to-find product, the rarity of star anise has attracted attention and high demand from countries such as India and China, as well as the US market.

Notable Export Results:

According to preliminary data from the Vietnam Pepper Association (VPA), Vietnam’s star anise exports in February 2024 reached 558 tons, generating revenue of 3.4 million USD. Overall, in the first two months of the year, revenue reached 7.9 million USD from 1,437 tons of star anise, although there was a slight decrease of 2.3% compared to the same period last year. India, importing 731 tons, accounted for 50.9% of total exports, followed by the US market with a rate of 9.3%.

Key Export Enterprises:

Among the companies contributing to this achievement, Prosi Thang Long and Nedspice lead with export volumes of 333 tons and 109 tons, respectively.

Market Prospects and Potential:

Looking ahead, according to a report by Fortune Business Insights, the herbal product market, including star anise, is expected to reach a value of 430 billion USD by 2028. Vietnam, with over 5,100 species of medicinal plants and a promising environment, is poised to become a significant player in this economic sector.

Pepper Prices Surge on February 21: Continues to Rise for Three Key Reasons

Today’s pepper prices on February 21 range between 86,500 – 89,500 VND/kg. In other pepper-producing countries such as India, Indonesia, and Brazil, production is also forecasted to decrease. This will lead to a reduction in pepper imports into Vietnam in 2024.

In Dak Lak and Dak Nong provinces, today’s pepper prices were purchased at 89,000 VND/kg, an increase of 2,000 VND/kg.

In Gia Lai province, today’s pepper price is at 86,500 VND/kg, up by 1,500 VND/kg.

Meanwhile, in Dong Nai, today’s pepper price is at 87,000 VND/kg, an increase of 2,000 VND/kg.

In Ba Ria – Vung Tau province, today’s pepper price is at 89,000 VND/kg, up by 2,000 VND/kg.

And in Binh Phuoc province, today’s pepper price was purchased at 89,500 VND/kg, an increase of 1,500 VND/kg.

Today’s pepper prices increased by 1,500 – 2,000 VND/kg in other localities compared to the same time yesterday. This marks the second consecutive day of strong increases in the domestic market.

The increased demand from various markets such as the US, EU, Asia, and Africa for immediate delivery orders in Q1 2024 has driven prices up even as Vietnam enters the peak of the harvest season.

At the close of the latest trading session, the International Pepper Community (IPC) listed the price of Lampung black pepper (Indonesia) at 3,905 USD/ton, a decrease of 0.18%; Brazil ASTA 570 black pepper at 4,100 USD/ton, up 50 USD/ton; and Kuching (Malaysia) ASTA black pepper remained at 4,900 USD/ton.

The price of Muntok white pepper is 6,157 USD/ton, down 0.18%; the price of Malaysia ASTA white pepper remains at 7,300 USD/ton.

Vietnamese black pepper traded at 3,900 USD/ton for the 500 g/l variety, and the 550 g/l variety at 4,000 USD/ton; white pepper at 5,700 USD/ton.

Speaking to the press, Mr. Nguyen Tan Hien, Vice President of the Vietnam Pepper and Spice Association (VPSA), commented that Vietnam’s pepper production in 2024 could be at its lowest in the past five years.

Mr. Hien added that in other pepper-producing countries such as India, Indonesia, and Brazil, production is also forecasted to decrease. This will lead to a reduction in pepper imports into Vietnam in 2024. In Southeast Asia, Vietnam mainly imports pepper from Indonesia, but the price of Indonesian pepper is increasingly expensive as Indonesia’s main customers are Japan, South Korea, and China – who are willing to pay high prices. Therefore, Indonesia only sells to Vietnam when there is an excess supply.

For Brazil, despite lower prices than Vietnam, with the situation of drought and crop failure, Brazilian farmers will also not be in a hurry to sell at low prices. With low inventory levels, forecasted decrease in production, and lower import volumes, Mr. Nguyen Tan Hien believes that Vietnam’s pepper exports in 2024 could be at the lowest level in the recent five years. This means that prices are also expected to be high in the coming period.

Due to the impact of climate change, the 2024 harvest season is delayed compared to 2023, with Vietnam’s pepper production in 2024 expected to reach only 170,000 tons, a decrease of 10.5% compared to 2023.

Vietnam Pepper report 2023

Vietnam Pepper report 2023

Through evaluation and review of data compared with previous forecasts, Vietnam’s pepper output in 2023 is estimated at about 190,000 tons, up 3.8% compared to 2022.

Forcast of 2024 crop: floods occurred in July in the Central Highlands, especially in Dak Nong province, it will more or less affect the pepper garden if the pepper garden is not treated and drained to avoid waterlogging and flood rain. However, it is not as worried as the El Nino phenomenon that will take place at the end of the year and last until the beginning of next year, which leads to drought, lack of rain and may reduce Vietnam’s pepper production next year.

By the end of June 2023, Vietnam exported 152,986 tons of pepper of all kinds, black pepper reached 138,377 tons, white pepper reached 14,609 tons. Compared to the same period last year, the export volume increased by 21.8%, equivalent to 27,433 tons, but the export turnover decreased by 14.6%, equivalent to a decrease of USD 82.3 million.

The average export price of black pepper in the first 6 months of 2023 reached USD 3,484/ton, white pepper reached USD 5,011/ton, down USD 879 for black pepper and USD 1,070 for white pepper, respectively.

Vietnam domestic pepper market was closely reflecting the market. By mid May, the domestic price was still at 76,000 VND/kg, then the price dropped continuously and is now only around 70,000 VND/kg. Weak purchasing power from traditional markets such as the United States and Europe, plus signs of slowing down from the Chinese market, which has reduced buying since June, and the waiting for

the harvest of Brazil and Indonesia are the main factors. Reasons for the price of Pepper to go down.

Prosi Thang Long is the top 10 of the biggest exporters with 3,210 tons exporting to over the world.

Source: Vietnam Pepper Association